Built for lenders to automate an entire loan life cycle.

A platform with a centralised and integrated means of managing various aspects of loans management.

Find your solution

Solutions per lending type

Commercial Lending

Intercompany Lending

Consumer

Lending

Mortgage

Lending

Syndicated

Lending

for borrowers and lenders

Providing a secure and seamless digital borrowing experience

Automate Loan Management

Automated application processing, approval, disbursement, and repayment tracking with

reduced errors and manual paperwork, resulting in quicker loan processing.

Reduces costs and

increase profitability

Costs are reduced and operational efficiency is improved by eliminating paperwork, manual data entry, and manual calculations.

Enhanced Risk Management

Assess and manage risks effectively with credit scoring, risk analysis, and loan monitoring tools, with stunning visualization.

Streamlined customer experience

Borrowers can apply for loans online, track the status of their applications, and access real-time information.

Automated analytics and reporting

Using this data, lenders can improve loan products, optimize loan terms, and drive business growth.

Integration

Master data

created in the ERP system is shown in

LMS, and master data created in LMS

can be saved in the ERP system.

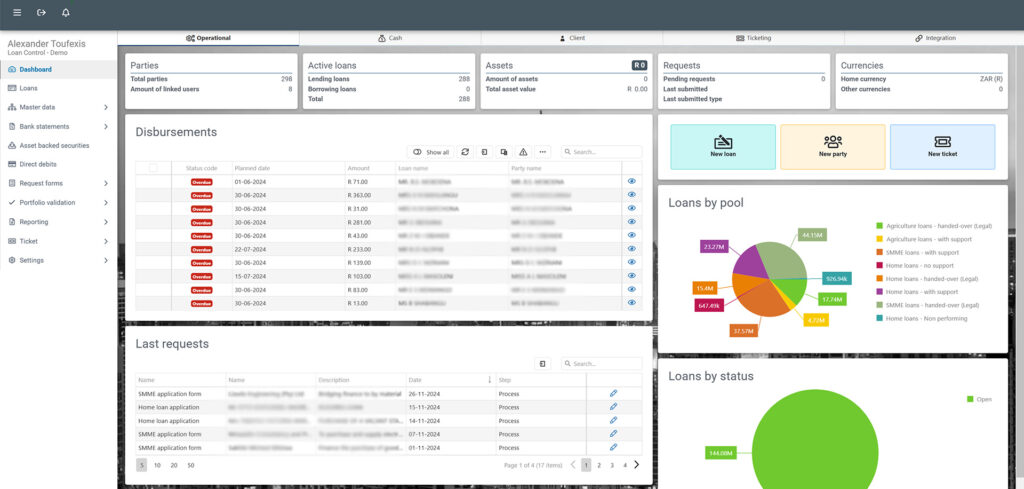

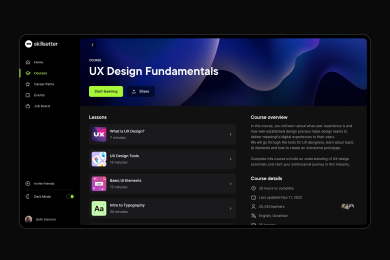

Data management and visualisation

Powerful dashboards

Integration & Recon

Client Dashboard

Cashflow Dashboard

Loan Product Overview

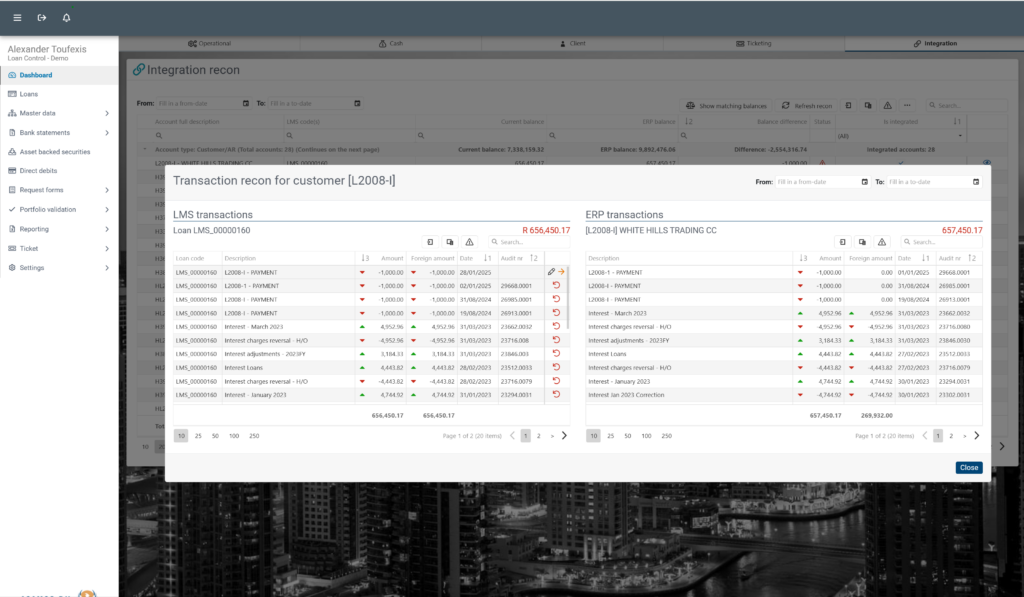

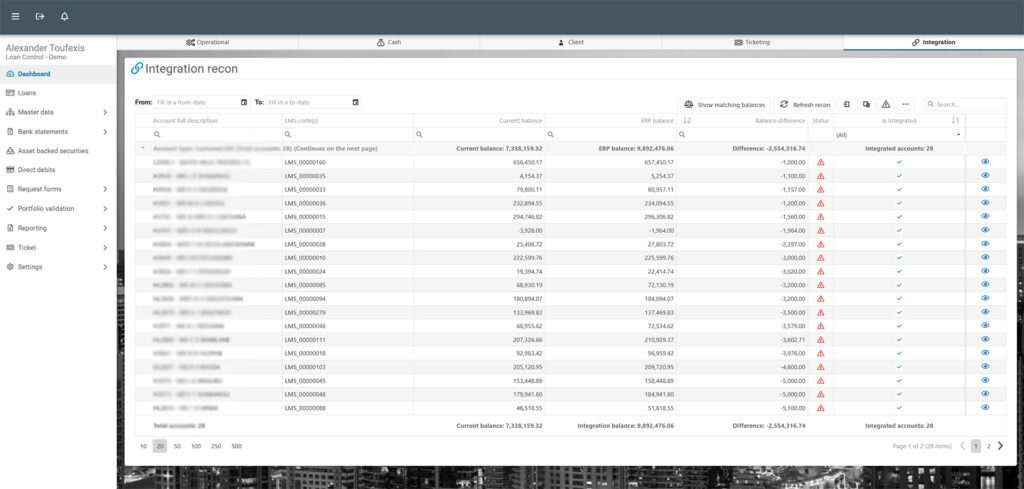

Integration dashboard features:

- Live verification with ERP

- Quick alignment on account level

- Direct posting into ERP

Client dashboard features:

- Quick client overview with key figures

- KPIs to monitor performance and financial health

- Upcoming payment overview

- Arrears and ageing

- CRM: tickets & new loan applications

Cashflow dashboard features:

- Forecasted incoming and outgoing cashflows (multi-period)

- Bank balance monitoring

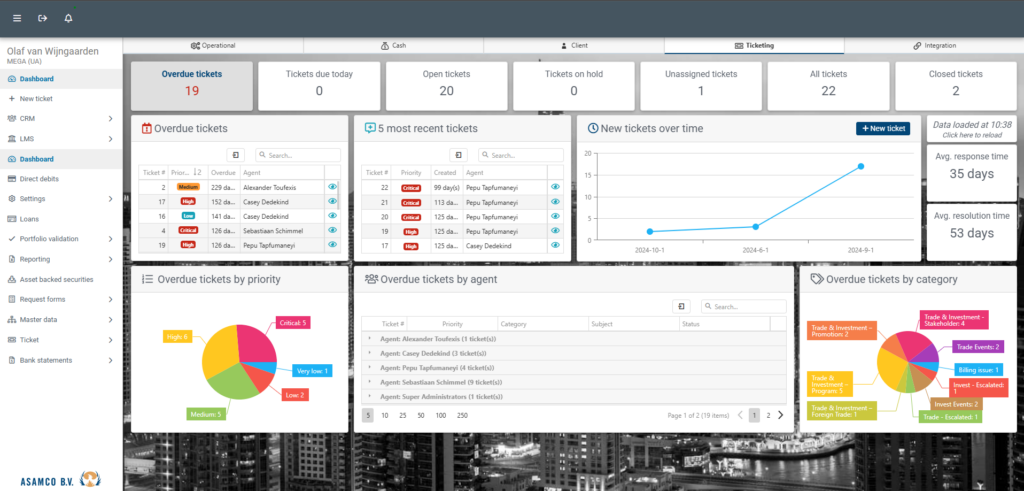

Loan product Overview dashboard features:

- Insert updated screenshot

- Overdue tickets

- Ticket assignments to agents

- Insight into action requests

- Quick responses on requests

- Communication tracking with clients

What our clients Say

Our solutions are trusted

world wide

Adriaan van Rooyen

Head of Reporting

Before the integration of LMS, our loan management processes were cumbersome, time-consuming,

and prone to human error. The need for a robust, efficient, and user-friendly system was critical to

overcoming these challenges and enhancing our operational efficiency. LMS emerged as the perfect

solution, offering a comprehensive suite of tools tailored to our needs.

The implementation of LMS has significantly streamlined our loan processing workflows. It has

automated many of the manual tasks that previously bogged down our staff, allowing them to focus

on more strategic aspects of their roles. The system’s intuitive interface and seamless integration with

our existing infrastructure have facilitated a smooth transition for all users, minimizing disruption to

our operations.

Petra van der Linde

Chief Financial Officer

Pallidus Capital (Pty) Ltd engaged Asamco B.V. during November 2023 for the implementation of LMS

and its underlying features. LMS has been implemented to the satisfaction of Pallidus Capital in so far as

it relates to the individual loans and each of its unique underlying characteristics.

Asamco B.V. and all its staff and representatives have been very helpful in all interactions and throughout

the implementation process.

They have always been solution-driven in their approach to meeting our

needs and requirements.

We continue to engage with Asamco B.V. as we look to further unlock the full potential of the LMS in our

unique circumstances.

Frequently Asked Questions

Customise features specific to your business needs

01

Customizable skin and reports

Support and Evolution Support and Evolution Support and Evolution Support and Evolution

02

Custom development and support

Support and Evolution Custom development and support Custom development and support

03

Various add-on modules

Support and Evolution Support and Evolution Support and Evolution Support and Evolution

Read Blog Article

The latest blog and article form feed

Payfod.io

- Posted on 3 days ago

PayPod: Imagine a World with Frictionless Payments

Fintech 09

- Posted on 3 days ago

Moving Money From Account to Account : Fintech

Payments.uy

- Posted on 3 days ago

PayPod: Imagine a World with Frictionless Payments