LMS Solution for Consumer Lending

Streamlined Solutions for Consumer Lending Success

Use cases

Personal loans

Personal loans are often unsecured or secured loans for any personal purpose, including debt consolidation, home renovations, medical expenses, etc.. The LMS will assist in managing personal loans efficiently.

Educational loans

Loans specifically designed to facilitate the financing of tuition and school fees for higher education. These can come from both governmental institutions or private institutions.

Pay-day loans

Short term, high-interest loans intended to cover immediate cash needs until the next payday. Crucial is smooth processing with minimum manual intervention.

Car loans (collateralized loans)

Car loans or other collateralized loans are used to finance larger purchases which can be used as underlying collateral as well.

Green loans

Loans specifically intended for financing environmentally friendly investments, such as solar power installations or energy-efficient home/building upgrades.

Streamlined loan origination

Automate and streamline

The LMS automates and streamlines the loan origination process, from approval application. It can quickly process applications, assess creditworthiness, and ensure all compliance requirements are met, speeding up the decision-making process.

Ready to be serviced

Moreover, upon full approval, the loan origination process will create the loan will all relevant parameters, ready for first disbursements and ready to be serviced.

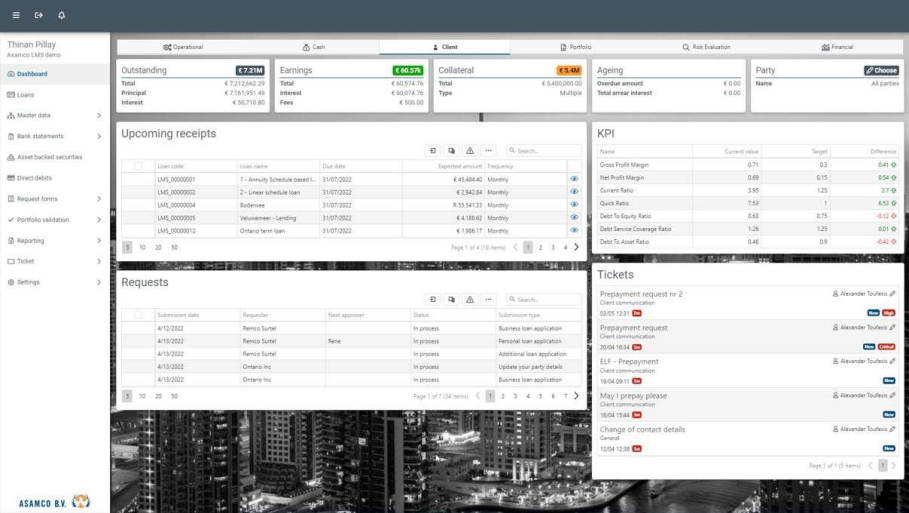

Risk assessment and management

Informed lending decisions

Our system can analyze various risk factors associated with commercial lending, such as the borrower’s credit history, and market conditions.

This helps in making informed lending decisions and setting appropriate loan terms.

Risk is managed

Our system can track various financial and non-financial parameters of the borrower to ensure that loan covenants are upheld, and risk is managed on the existing loan portfolio.

Features used

- Credit questionaires using flex forms

- CRM with client records

- Client financial statement tracking per period

- Client file on CRM

- Integration with credit bureaus for automated credit checks

- Integration with identity verification apps to facilitate KYC & AML

- Portfolio validation for portfolio level covenant tracking

- Custom KPI definitions and (exception) reporting

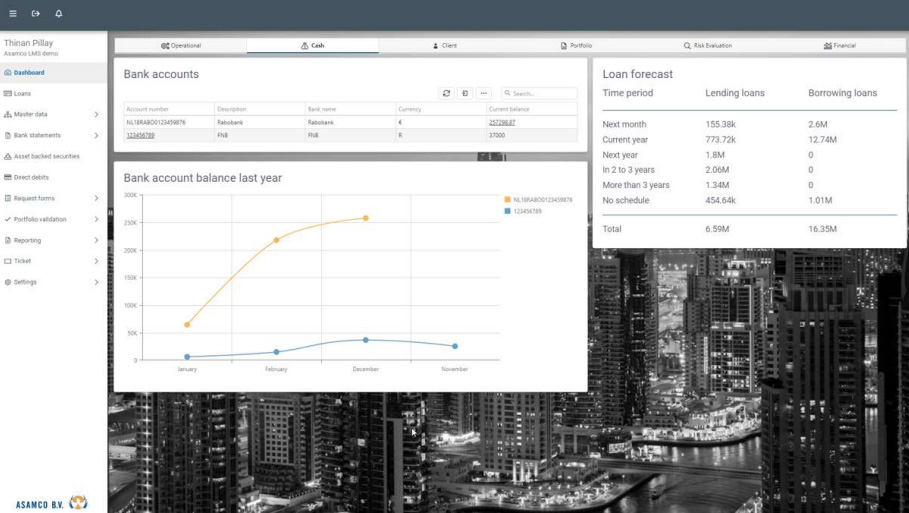

Loan Servicing for Consumer Lending

Payment Processing

An LMS simplifies the management of loan repayments. It tracks payment schedules, processes payments received, and manages any late or missed payments, including the calculation and application of penalties if applicable.

Adjustments and Restructuring

When necessary, the LMS can assist in modifying loan terms, restructuring debts, or adjusting payment plans in response to changes in the borrower’s circumstances or in case of refinancing.

Account Management

The system maintains detailed records of each loan, including balances, interest rates, repayment schedules, and transaction histories. This ensures that both the lender and borrower have up-to-date information on the loan status.

Compliance and Reporting

All loan servicing activities comply with regulatory requirements. It generates detailed reports for internal use and regulatory purposes, providing valuable insights into the performance and health of the loan portfolio.

Mass Interest Calculations

Interest can be calculated easily for a single loan or for all or multiple loans. This can be period or day based. Any related parameter to a loan will be taken into account. Any centrally managed variable interest will also be automatically updated in the mass interest calculation process.

Customer Service Communication

An effective LMS facilitates direct communication with borrowers. It can generate automated reminders for upcoming payments, provide online access for borrowers to view their loan details, and offer support for any queries or issues.

Default Management

In cases of default, our LMS can manage the process, including sending default notices, negotiating with borrowers, and handling collections or foreclosure procedures if necessary.

Customer management

The system can manage customer information, providing a centralized database for all borrower interactions, loan agreements, and communication history.

- CRM and customer records

- Customer – financial information tracking

- Tickets

- LMS Client portal

- Reporting – Notification runs

Previous

Next

Features used for Loan Origination

Application form module with flex forms

Workflows & automations

Client record creation

Loan products and templates

Details, Schedules and Interest Fee calculation parameters

LMS Client portal