Syndicated loan management

A critical tool for streamlining and optimizing various processes within Syndicated loan management process.

Syndicated loan management – Specifics

Lenders vs Borrower

Managing Multiple Lenders versus a Single Borrower within a Unified Loan Framework

Communication

Streamlined notifications and communication to related parties and contacts of parties

Fee & Interest Management

Easy pro-rated management of fees, interest and transactions

Lender Loan Segmentation

Partial loan assignments and sale transactions across different lenders

Personalized Financial Statements

Individual borrower and lender statements

Standardized reports

Capital call

Loan statement

Lender payment letter

Borrower payment request letter

Interest calculation letter

Overview of Syndicated Lending

Syndicated lending involves a group of lenders collaborating to provide a loan to a single borrower, typically for large corporate projects or debt consolidation. This method allows for larger loan amounts that might exceed the capacity of a single lender.

The primary benefit is risk distribution among multiple lenders, enabling them to contribute to significant deals while managing individual exposure. For borrowers, syndicated loans offer access to larger capital sums with competitive terms.

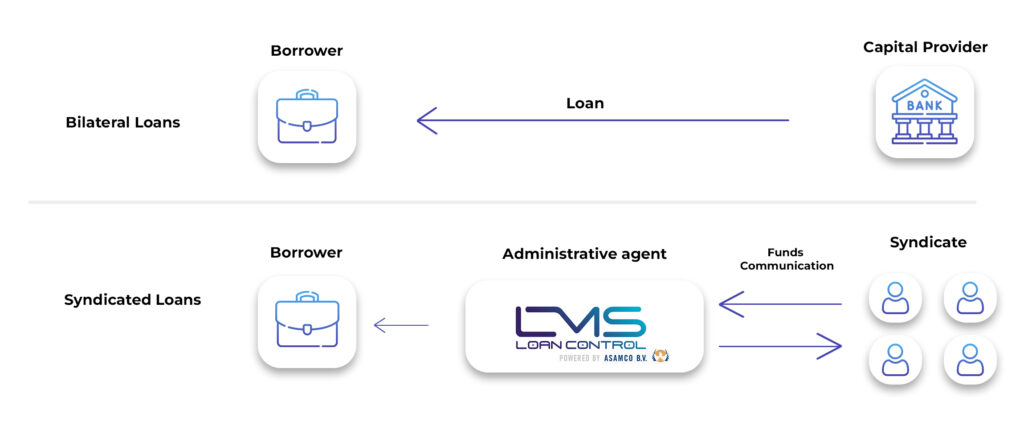

Comparison with Bilateral Lending:

In contrast, bilateral lending involves a direct loan agreement between a single lender and a borrower. This form of lending is typically more straightforward and involves fewer participants, making it suitable for smaller loan amounts or for borrowers with more conventional financing needs.

Key Differences:

01

Number of Lenders

Syndicated lending involves multiple lenders, while bilateral lending involves just one

02

Loan Siz

Syndicated loans are generally larger, reflecting the combined capacity of the syndicate members.

03

Complexity

Syndication involves coordination among multiple lenders, while bilateral lending is a simpler negotiation between two parties.

04

Risk Distribution

Risk is shared among the syndicate, while in bilateral lending, the lender bears the entire risk.

Syndicated lending versus bilateral lending:

The illustration visually explains these differences, providing a clear understanding of how syndicated lending diversifies risk and facilitates larger financing arrangements compared to bilateral lending.

Syndicated Lending

1. Origination

Borrower’s Proposal: The process begins with the borrower identifying a need for a large sum of money that might be too big for a single lender or requires a syndication to diversify risk.

Mandate Letter: Once a bank (lead arranger) shows interest in the borrower’s proposal, it may issue a mandate letter, formalizing its intention to arrange the syndicated loan.

2. Structuring the Deal

Lead Arranger’s Role: The lead arranger, often a major bank, takes the primary role in setting the terms of the loan, including the interest rate, repayment schedule, and covenants.

Syndicate Formation: The lead arranger then invites other financial institutions to join the syndicate, sharing the loan amount and risk.

3. Marketing the Loan

Information Memorandum (IM): The lead arranger prepares an IM, detailing the terms of the loan and the borrower’s financial information, and circulates it among potential syndicate members.

Syndication Strategy: The syndicate might opt for underwritten, best-efforts, or club deals, depending on the risk appetite and the market conditions.

4. Syndication and Closing

Commitments: Interested lenders commit to a portion of the loan. Once enough commitments are secured, the syndication phase is considered closed.

Documentation and Agreement: Legal documents are prepared, outlining all terms and conditions of the loan. All parties sign the loan agreement, making the deal official.

5. Funding

Initial Drawdown: The borrower can now access the funds, often through an initial drawdown, according to the terms set out in the loan agreement.

6. Administration and Monitoring:

Agent’s Role: An administrative agent (often the lead arranger) is responsible for managing the loan, including the distribution of payments, communication between the borrower and the lenders, and ensuring compliance with the loan agreement.

7. Repayment

Scheduled Payments: The borrower makes regular payments according to the loan’s amortization schedule until the loan is fully repaid.

Prepayment and Refinancing: The borrower may have options for early repayment or refinancing, subject to the terms of the agreement.