LMS solution for Intercompany Financing

Intercompany Financing – Empowering Precision in Loan Management.

Use cases for Intercompany Financing

Intercompany Loans

Intercompany loans can be recorded both on the liability as well as on the asset side of the balance sheet in group companies.

The LMS will facilitate proper tracking and interest calculation between the companies. Moreover, the integration into the accounting system will facilitate ease of processing.

Intercompany Current Accounts

Intercompany current accounts can be tracked, allowing the balance to go either way and have a central account between companies. Interest calculated will take into account the positive or negative balance between entities without the need to make separate loan accounts for this.

Intercompany Financing Compliance

Intercompany contracts

Automated document creation will ensure ease of contractual compliance between entities. The linked document management system will allow for the maintaining and tracking of documents related to the intercompany loans.

Intercompany interest calculation

Intercompany interest calculations can be managed centrally and reduce work. Cross-entity checking of balances also becomes simpler to ensure reconciliation.

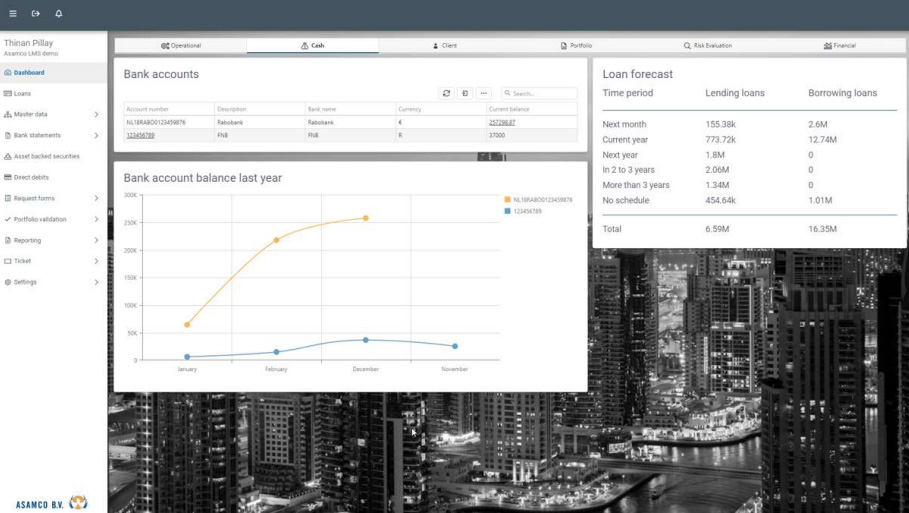

Loan servicing – Intercompany Financing

Payment Processing

Our LMS simplifies the management of loan repayments. It tracks payment schedules, processes payments received, and manages any late or missed payments, including the calculation and application of penalties if applicable.

Account Management

The system maintains detailed records of each loan, including balances, interest rates, repayment schedules, and transaction histories. This ensures that both the lender and borrower have up-to-date information on the loan status.

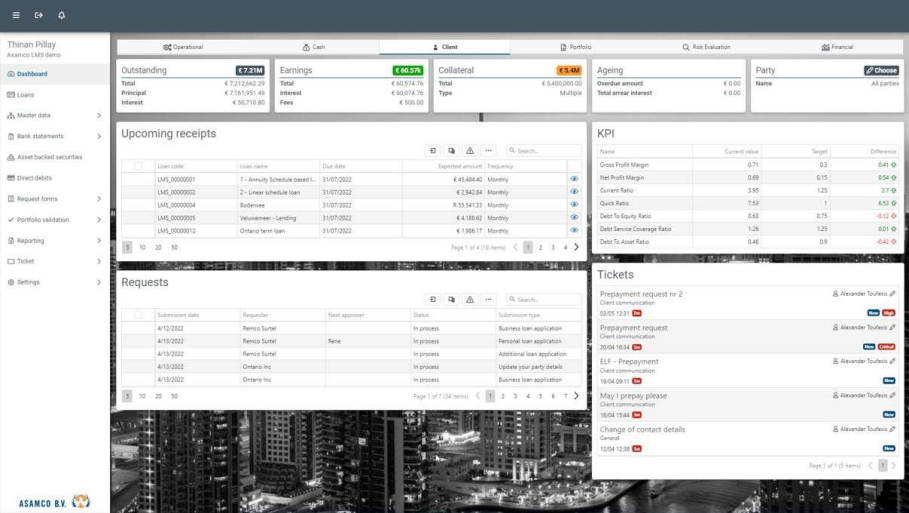

Compliance and Reporting

All loan servicing activities comply with regulatory requirements. It generates detailed reports for internal use and regulatory purposes, providing valuable insights into the performance and health of the loan portfolio.

Multi-currency support

In an international environment, multi-currency tracking of loans across entities is crucial. LMS ensures this is done efficiently and facilitates fx revaluation on loans in foreign currencies

Adjustments and Restructuring

When necessary, the LMS can assist in modifying loan terms, restructuring debts, without the need of creating a new loan.

Customer management

The system can manage customer information, providing a centralized database for all borrower interactions, loan agreements, and communication history.

- CRM and customer records

- Customer – financial information tracking

- Tickets

- LMS Client portal

- Reporting – Notification runs

Previous

Next